The money to buy The West Hill and Wimbledon Park Estates – Where did John Augustus Beaumont obtain it?- Part II

This series of blogs in our From The Archives series is intended as a resource for schools and local residents who are interested in researching local history.

We are very happy to help schools with access to relevant materials. However, the images that are reproduced here should be assumed to be the copyright and may not be reproduced without license from the archives and commercial use is therefore strictly prohibited.

Author’s note

It is rather easy to paint John Augustus Beaumont with a large black tar brush in all of this. The real sense is that he bought 310 acre The West Hill Estate for the sum of £40,500 or £130 an acre and was promptly selling parts of it for £250 -300 an acre at a decent pace. This is a very good business return by any standards. At which point he then spent the relatively modest amount of £14,250 to buy a small part of Wimbledon Park from Earl Spencer and so the scheme rolled on. So far so good.

Then Beaumont bought most of the rest of Wimbledon Park for the astronomical sum of £80,000. OK, it was rather cheap per acre but this does appear to have been a major overreach.

It is quite a different thing to be trying to sell off 400 acres of real estate as opposed to 1200 acres which was what he was saddled with and the market only had so much capacity to absorb sales.

Towards 1862 things had clearly come good as Melrose Hall and 25 acre was sold for the then significant sum of £18,000. Assuming the house might have been worth £5,000 that then gives a land sale value of around £500 per acre. A fantastic yield when it was purchased for £130 an acre.

The other thing to bear in mind is that virtually every other businessman was doing what Beaumont was doing and borrowing money from their company to buy lands and to sell or develop them for housing. It was quit the thing at the time.

So the conclusion is that the business proposition was sound but that Beaumont got a bit carried away with his great scheme. Some of the actions and statements made don’t bear close inspection. Fortunately it all came right in the end.

How much was paid for each parcel of lands?

We know from primary sources that Beaumont paid the following sums for the lands that came to make up The Wimbledon Park and West Hill Estate.

- £40,500 – source Duke of Sutherland’s bank book – 9th August 1842

- £14,250 – source conveyance of lands – dated 12th August 1843

- £80,000 – source Earl Spencer’s papers – 18th October 1845 to 31st December 1845 various payments (some interest payments also)¹

Making a total documented purchase price of £134,750.

[There is also a payment shown in The Duke of Sutherland’s bank book from the sales agent, Charles Farebrother, on 9th January 1843 for the sum of £4,013. It is just about possible that this was the 10% downpayment less commission that was customarily made, at the time, to seal a holding position. However, the date is wrong as it is well after the main transaction was undertaken].

How did events unfold?

There are two versions of this story – The Aubrey Noakes version of 1957 and the alternative version taken directly from the account sheets and directors minutes of The County Fire Office [CFO]. The original records survive remarkably intact.

Noakes’ book needs to be taken with a very large pinch of salt. The whole book is highly self congratulatory and he gives no exact references.

The Aubrey Noakes version of 1957

The answer as to where John Augusts Beaumont got the money to buy half of Wimbledon and Wandsworth from was that he had mortgaged his lands to CFO in or about 1846. It appears not all the shareholders knew about this or were delighted about it, as Beaumont, who was the Managing Director of CFO, was forced to repay the monies to CFO within six months [this is erroneous]. We can see, from various deeds, that there was a hurried program of disposals and that Beaumont then took onboard other mortgagees, to enable the repayments to CFO, from extant deeds [this is erroneous]. A number of authorities appear to have used the numbers of £43,000 and £92,300 as the values paid for the lands – this is probably not the case, and it was merely the extent of Beaumont’s remortgaging activities.

What this actually appears to mean is that Beaumont reduced the mortgages down to two thirds of the value of the lands rather than repaying them in full [this is erroneous].

Beaumont was quite the pamphleteer and rather enjoyed arguing with his accusers.

The matter finally simmered down in 1859. Noakes states, in his book [‘The Country Fire Office’ – Commemorative Publication – 1957 – Aubrey Noakes] “when the mortgages on both estates were finally cleared in a report dated 24th February 1859 by the West Hill and Wimbledon Park Estates Committee to the Annual General Meeting of CFO” [this is erroneous].

The version from CFO Board of Directors’ minutes books

Fortuitously, almost the full run of CFO Main Board minute books and account books have survived so we can piece together, with some accuracy, exactly what was going on and what was said from contemporaneous records. We have added to that some extant fragments of banking records. This is our preferred versions.

The loans are exposed to the shareholders and a special committee is set up to monitor The West Hill & Wimbledon Park Estates

The whole matter erupts in the main board minutes on 27th February 1846 at an Adjourned General Meeting. The original meeting was to have been on 13th February 1846 where a committee was appointed that reported on the 27th – fast work. The committee reported [read the the full initial nine page report as a PDF here].

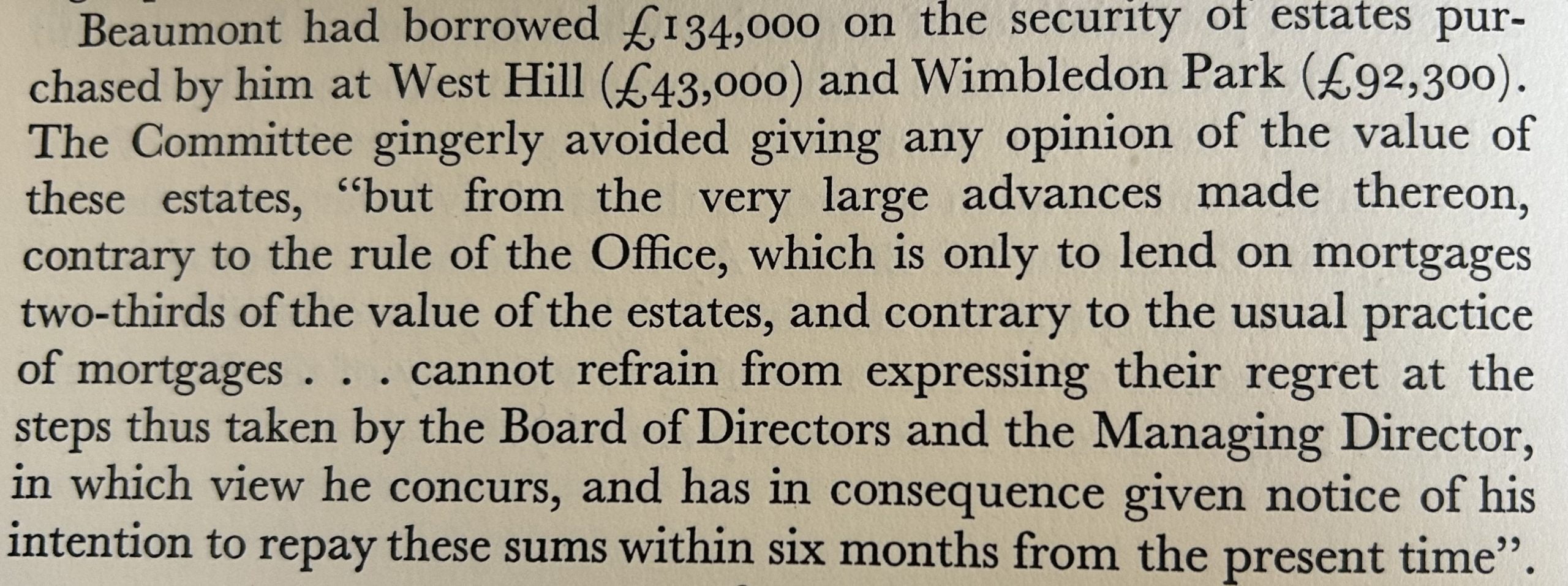

“Your committee find that the sum of £336,217 has been lent on mortgage and other securities of varied character – two mortgages of large amount have been recently taken of the Managing Director in which there appears to be a degree of confidence exercised…….on the part of the Board of Directors which in the estimation of your committee is not altogether justifiable.

Your committee are unable to offer an opting upon the value of these estates, but from the very large advances made thereon, contrary to the rule of the office…..which is only to lend on two thirds of the value of the Estates…….”

There is then a series of periodic reports from West Hill and Wimbledon Park Estate Committee for the period 27th February 1846 and 23rd February 1850 as a PDF.

There is an interesting inscription at the head of CFO’s Drummonds account book, which is quite illuminating.

Special report of February 1850 detailing the extent of the loans and progress in paying them down

There is then a fascinating special report from the Committee set up to oversee The West Hill and Wimbledon Estate in the CFO minutes. This sets out in some detail exactly what the extant mortgage amounts were. Read the PDF of the special report to the Board here and make up your own mind!

The thing that does shine through all of this is the inordinate amount of time that The Board of Directors were expending on keeping an eye on their Managing Director’s property empire. This must have been a massive distraction from running an insurance concern.

Winding down the loans

You can read the minutes relating to The West Hill and Wimbledon Park Estate Committee, after the February 1850 special report, setup by the CFO Board here. You can unusually see the values of the transactions, between CFO and the Cotton Finches family, that are made either side of where Wimbledon Park Road joins Merton Road in these minutes. The Board were clearly very concerned to draw a line under this matter but at the same time to keep a very close eye on what was going on.

The effects on the business are all too easy to see from the account books which largely survive.

The CFO account books

These make it clear that at one point 109% of the entire asset value of CFO was tied up in mortgages. It was over 100% as some of the other assets had a negative book value in the accounting conventions of the time. This clearly was not a great position that such a large percentage of the assets were tied up in one potentially illiquid asset class.

Also it may be worth the thought that using the company’s assets in this way stunted the growth of the company. It is probably not a coincidence that the assets value and turnover of the company stated to increase sharply as the assets were used better for the overall function of the business.

| Year | Mortgages | Total Assets | % Mortgages | |

| 1845 | £336,217 | £502,244 | 66.94% | |

| 1846 | £346,070 | £450,823 | 76.76% | |

| 1847 | £332,911 | £440,447 | 75.58% | |

| 1848 | £304,562 | £430,443 | 70.76% | |

| 1849 | £309,977 | £370,749 | 83.61% | |

| 1850 | £299,589 | £371,875 | 80.56% | |

| 1851 | £294,647 | £384,227 | 76.69% | |

| 1852 | £343,198 | £391,831 | 87.59% | |

| 1853 | £328,850 | £404,622 | 81.27% | |

| 1854 | £333,185 | £399,696 | 83.36% | |

| 1855 | £341,019 | £398,302 | 85.62% | |

| 1856 | £298,097 | £359,640 | 82.89% | |

| 1857 | £385,771 | £354,009 | 108.97% | |

| 1858 | £370,586 | £360,767 | 102.72% | |

| 1859 | £282,345 | £363,422 | 77.69% | |

| 1860 | £271,575 | £380,029 | 71.46% | |

| 1886 | £297,017 | £586,057 | 50.68% | |

| 1887 | £281,162 | £600,887 | 46.79% | |

| 1888 | £277,092 | £631,988 | 43.84% |

It is worth noting that the presentation of the accounts changed in 1850 to what we would now recognise as a balance sheet. So it is possible that the pre 1850 accounts may not be totally comparable with the post 1850 ones. However, there is a distinct pattern to events.²

Financial sanity and diversity was clearly being restored quite rapidly in 1859 to 1860 when the situation came under control.

You can read a sample of the annual audited account and make up you own mind! For a selection of years between 1840 and 1888 (we haven’t included every year as the file simply becomes too big click here).

However, it may not be as simple as the mortgages being repaid to CFO as there is substantial evidence of other mortgages so this looks more like an effort to get the mortgages off CFO’s books so that it is a private matter. For instance there is a letter in Earl Spencer’s papers from 1859 concerning a request for an inspection of deeds for the purpose of a mortgage. However, the name of the putative mortgagee is crossed out suggesting a late change of plan.

Although we have found that a member of Gurney family and Provident Life, the sister company of CFO, were defendants with Beaumont named [TNA C 16/344/G79] “Amended by order 1867. The Provident Institution for Life Insurance of London by John Augustus Beaumont is managing director added as defendant.”. So that could be how the connection arose?

[This is the subject of ongoing further research]

You can read the full deed here.

Continue reading – Part III – The District Line & Wimbledon Park Estate

We are very grateful to RSA Group for permission to publish the original records of CFO. Barclays and NatWest have very kindly allowed us to reproduce items from their archives.

¹ We have tracked CFO’s banking down to Drummonds.

Interestingly the massive £80,000 payment to Beaumont does not show up in the 1845 ledger and this gives some credence to the idea that Beaumont had taken the monies prior to the transaction completing. The series of odd value payments made by Beaumont to Earl Spencer in 1845 is also suggestive of assets being sold to make these payments.

We are currently evaluating what other sources there might be extant to bottom this out.

² While all this is going on, Beaumont is busily lecturing other insurers as to how to conduct themselves. For instance in this 1852 pamphlet entitled “A FEW LINES ΤΟ The Managers of THE LIFE INSURANCE SOCIETIES of THE UNITED KINGDOM, SUGGESTING A REMEDY FOR THE DOUBTS AND DIFFICULTIES ATTENDANT UPON THE BUSINESS OF LIFE INSURANCE.’ It is hard to know what to make of this.

³ Personal communication with Barclays Group Archivist 5th January 2024

‘I have conducted some searches and have found a document directly relevant to your case, but from an unexpected direction. This is a declaration of trust concerning a mortgage on the Wimbledon Park estate taken out by Beaumont in 1872, but from the Gurneys of Norwich rather than Ransom Bouverie of Pall Mall (see scans attached). As you will see, the total amount was £51,000, of which £35,000 came from John Gurney’s other relations.

I searched in the Norwich bank records, which are far from complete, but nevertheless I could find no trace of this huge loan, from which I infer it may have been a private transaction. If so, this makes it more interesting in a way. The Gurneys were well known public figures and were well connected, most obviously through the Quaker brotherhood, but also in intellectual and cultural circles. Perhaps they were already acquainted with Beaumont when the mortgage was arranged?

I can confirm a connection between CFA/Beaumont and Ransom Bouverie. Alas, no current account ledgers survive for that period, but the indexes do. In these, Beaumont appears first as a customer in the 1839 volume, and was still there in the 1870s. I can’t find CFO in the indexes prior to 1865. I looked through several partners’ ledgers that include records of loan accounts, and bundles of correspondence with brokers, solicitors and customers (ref. 3/1964), but could find no mention of either Beaumont or CFO there. However, the loan records show that Overend, Gurney was a major customer of Ransoms, owing the latter some £210,000 when the crash came.

So, something of a mystery as to why Beaumont mortgaged in 1872 to the Gurneys and not with Ransoms – unless he had already borrowed from the latter, earlier on in your 1840-70 period, and perhaps already repaid any loan.’